The current analysis focuses on the PI/USDT cryptocurrency trading pair, highlighting recent price movements, volume trends, and potential scenarios for the near future.

Overview of Current Market Conditions

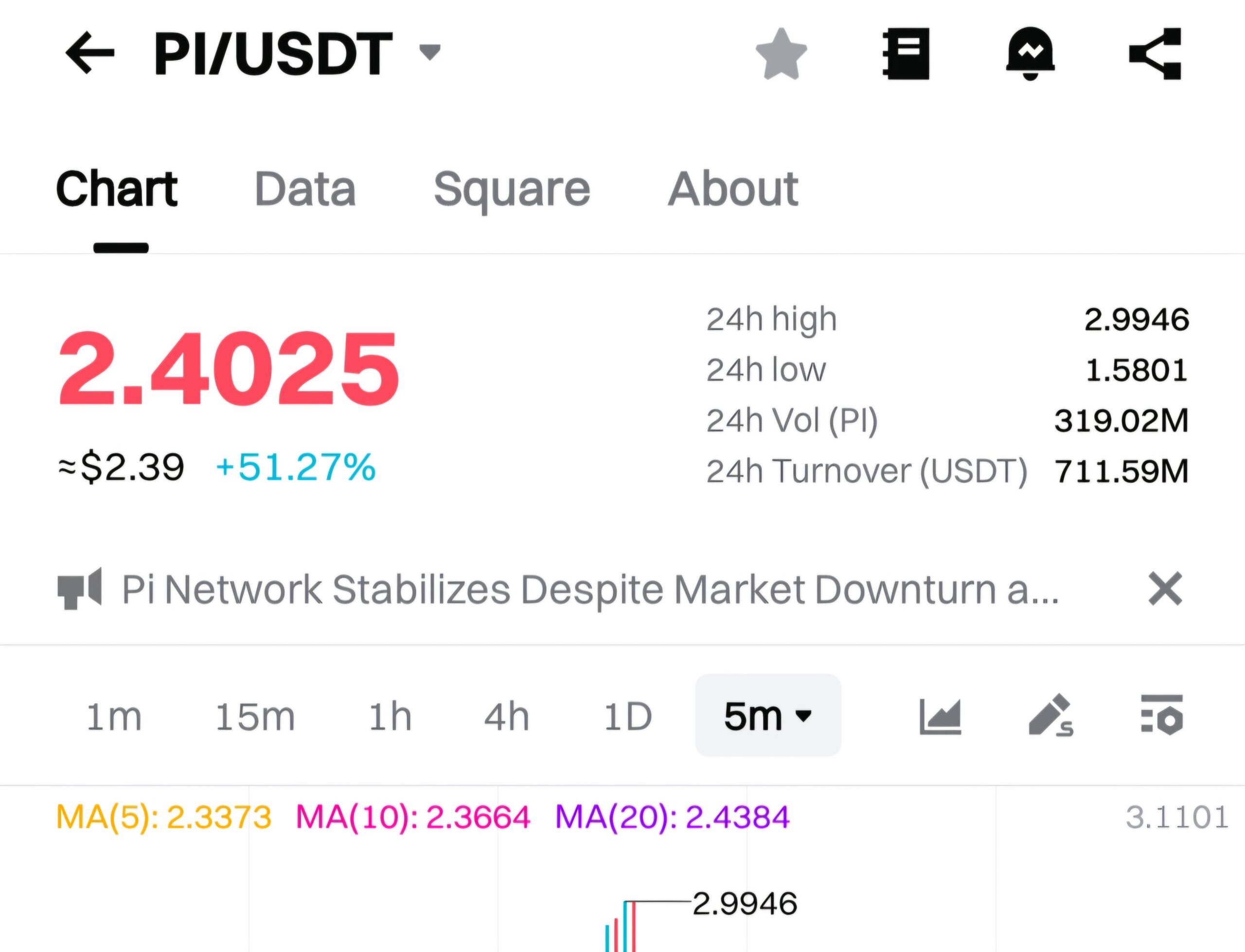

- Current Price: 2.4025 USDT

- 24-Hour Price Change: +51.27%

- 24-Hour High: 2.9946 USDT

- 24-Hour Low: 1.5801 USDT

- 24-Hour Volume (PI): 319.02 million

- 24-Hour Turnover (USDT): 711.59 million

The pair has experienced significant volatility, with a notable increase of 51.27%. The price has oscillated between a high of 2.9946 USDT and a low of 1.5801 USDT, showcasing the volatile nature of cryptocurrency markets.

Moving Averages Analysis

- MA(5): 2.3373 USDT

- MA(10): 2.3664 USDT

- MA(20): 2.4384 USDT

The current price of 2.4025 USDT is above the 5-period and 10-period moving averages but slightly below the 20-period moving average. This suggests short-term bullish momentum but indicates caution as the price approaches the longer-term average.

Volume Analysis

- Significant Volume Spike at 15:30 on 02-26: 157.44K

- Volume Moving Averages: MA(5) at 2.05M, MA(10) at 1.86M

A notable spike in volume indicates increased trading activity and potential market interest, which could be due to recent news or developments related to the PI Network or broader market trends.

Possible Scenarios for Tomorrow

- Bullish Continuation:

- If the bullish momentum continues, the price could test the recent high of 2.9946 USDT.

- Traders should watch for sustained volume and upward price movement, as this could indicate further gains.

- Pullback and Consolidation:

- If selling pressure increases, the price may retrace to the support levels indicated by the moving averages or the recent low of 1.5801 USDT.

- Consolidation near these levels could lead to a period of sideways trading before the next major move.

- Trend Reversal:

- A significant drop below the 20-period moving average (2.4384 USDT) could signal a trend reversal, leading to further declines.

- Traders should be cautious and monitor for signs of bearish momentum.

Key Factors to Monitor

- Market Sentiment: Changes in overall market sentiment can heavily influence cryptocurrency prices.

- External News: Regulatory news, technological developments, and macroeconomic factors can impact the PI/USDT pair.

- Volume and Price Action: Monitoring volume spikes and price movements can provide insights into potential trend changes.

In summary, while the current bullish momentum is promising, traders should remain vigilant and consider various scenarios. Staying informed about market conditions and external factors will be crucial in making well-informed trading decisions.